Loan Default Prediction - Analyzing Kowope Mart Data

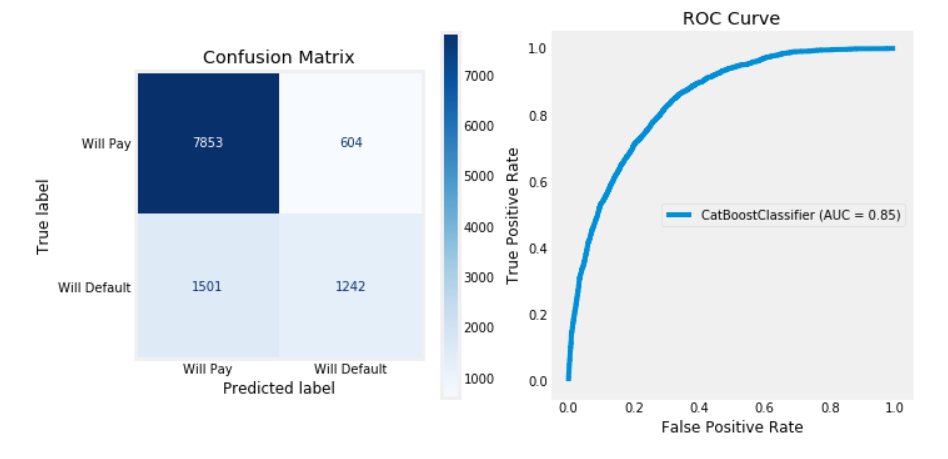

AIM: To help Kowope Mart to identify customers who are worthy of credit card, lines and loans by identifying which customers are at risk of defaulting in payment of loan.

Kowope Mart is a Nigerian-based retail company with a vision to provide quality goods, education and automobile services to its customers at affordable price and reduce if not eradicate charges on card payments and increase customer satisfaction with credit rewards that can be used within the Mall. To achieve this, the company has partnered with DSBank on co-branded credit card with additional functionality such that customers can request for loan, pay for goods even with zero-balance and then pay back within an agreed period of time. This innovative strategy has increased sales for the company.

The Challenge:

- There has been recent cases of credit defaults and Kowope Mart will like to have a system that profiles customers who are worthy of the card with minimum if not zero risk of defaulting.

Action: Leveraged various python packages in Machine learning to predict customers who are likely to default or not.

Skills/Packages Used: Supervised ML, Numpy, Pandas, Matplotlib, Scikit-learn, Lightgbm, Xgboost, CatBoost, RandomizedSearchCV, StratifiedKFold